by Flagship Staff | Aug 4, 2020 | Blog

While West Bend designs our home and auto insurance forms to be coverage rich, we do practice restraint in automatically including bells and whistles. This is because we want to keep it affordable and competitive and provide you with options.

That said, you can request to add a number of these bells and whistles, also known as additional coverages, to your Home and Highway® policy. Here are three of the more common coverages you may purchase for your home and three for your auto(s). Some of these coverages are for losses that are more likely to occur, while other coverages are for losses that are less likely but more costly.

Let’s start with the Personal Auto Policy since most people own a car and most states require you carry insurance on it.

TravelNet® Emergency Roadside Assistance (aka towing and labor)

This coverage provides emergency roadside assistance if your vehicle becomes disabled due to a flat tire, no fuel, dead battery, lock out, and other minor repairs. We offer limits up to $150 per disablement.

In addition, if the disablement occurs more than 100 miles from your home and you’re stuck elsewhere overnight because of necessary repairs, this coverage provides up to $250 for lodging, meals, and alternate transportation.

The TravelNet dispatch facility is open 24 hours a day, 365 days a year. If you’re familiar with AAA, this coverage is similar. If you’re already a AAA member, you may want to compare those benefits before adding TravelNet.

Auto Loan/Lease Coverage (aka GAP)

This provides coverage for the difference between an outstanding balance on a loan or lease and the actual cash value of the vehicle at the time of a loss or accident. If you have a trade-in or a solid down payment, you may not need this coverage. But if you’re financing a new model year car with no or little money down, this coverage offers great protection for the expected depreciation on the vehicle. Dealerships often recommend or offer this with financing. We find our coverage is equal to theirs and less expensive.

Car Damage Replacement Coverage (aka new car)

If an accident results in a total loss to your vehicle, this coverage changes the claim settlement from actual cash value with deduction for depreciation to replacement cost. This means we’ll replace the damaged vehicle with a new vehicle of the same make and model. If the exact model is no longer in production, we’ll replace it with a new vehicle of similar size, class, and equipment. So if you’re concerned about depreciation on your vehicle or about having to find a good used vehicle if yours is totaled, you may want to consider purchasing this coverage.

This option expires when the vehicle is five model years old and is not available on a leased vehicle.

Now on to Homeowners insurance.

Protector Plus is a package option that includes four popular coverages. These can also be purchased individually but are priced more competitively when purchased as a package.

- Identity Protection Coverage

Identity theft crimes are on the rise. Our ID protection program offers services to help you avoid these crimes, including tax fraud, as well as other situations in which fraud may occur like travel, disaster recovery, medical, relocation, military, marriage, child risk, and estate.

If your identity is stolen, the service also aids in resolution. While the service alone can often remedy an event without any cost to you, there is a $30,000 limit for expenses related to an identity theft crime. This can help cover attorney fees, lost wages, phones bills, and other related costs and fees.

This is an important coverage if there’s a total loss to your home and you must rebuild and secure a new mortgage. It will pay the difference in your mortgage interest rate if the new rate is higher. Mortgage extra expense will pay up to $250 a month for up to four years. It also provides $2,000 in coverage for acquisition costs (closing, appraisal, title, etc).

- Special Personal Property Coverage

This endorsement broadens the coverage for your personal property from specific named perils to all-risk coverage, subject to certain exclusions. Here are some examples.

Your accidentally throw your Wii remote (or other gaming system controller) through the TV shattering the screen.

The power company is working on the lines outside your home and blows a transformer. The surge causes damage to everything plugged into your outlets!

Due to its weight your crystal chandelier falls from the ceiling onto your mahogany dining table scratching and denting the solid wood.

The possibilities are endless therefore this coverage should be added your policy!

- Water Backup and Sump Overflow Coverage

If water backs up or your sump pump overflows causing damage to your home, mechanicals, or possessions, you’ll have coverage up to the selected limit. We have limits up to $125,000 available! This type of loss happens more frequently than flood. Water can travel fast and far, causing a lot of damage, making this another coverage you’ll want!

For those who rent, three of the key coverages listed here – Identity Theft, Special Personal Property Coverage, and Water Backup and Sump Overflow – are available to add individually to a renter’s policy.

Protector Grand adds increased limits and peril coverage to both your home and contents. At $25, it’s great protection for minimal cost!

- Additional $5,000 of coverage for your jewelry for a total of $10,000.

- Coverage if your home collapses due to hydrostatic pressure (ground water).

- Landslide coverage. Wisconsinites may remember when Lake Dalton disappeared and took several homes with it. This CAN happen in the Midwest!

- $1,000 of coverage to protect sports and hobby equipment.

- Waiver of your Homeowners deductible if you suffer a loss to your personal property while traveling.

- $500 for food stored in a refrigerator or freezer that spoils during a power outage.

- $10,000 for your share of a loss assessment. This is especially important for those who are members of a condo or homeowners association.

- $2,500 of coverage for an owned golf cart.

Underground Service Line Coverage

Underground service lines consist of exterior pipes and wiring that provide services to a home, such as electrical, heating, gas, water, waste. These lines can be damaged by causes not covered by the standard Homeowners policy (or your municipality) like freezing, corrosion, tree roots, and rodents or insects, for example. We now offer coverage up to $15,000 to repair or replace the underground service line, including excavation costs and damage to your trees, plants and lawns, and driveways and walkways.

West Bend offers many options to customize your insurance policies and meet your specific needs. I truly had a difficult time narrowing it down to just the ones mentioned here. As always, we recommend you discuss this with your trusted independent insurance agent. Your insurance advisor is qualified to answer your questions and help manage your risk.

by Flagship Staff | Jul 28, 2020 | Blog

With busy lifestyles, it’s often hard to find free time for ourselves. Sometimes, however, we need to purposefully schedule relaxing time in the day or the week to enjoy a favorite pastime. It could be playing your favorite sport, enjoying an outdoor activity, taking pictures, or making crafts.

Some hobbies require an investment in equipment and supplies. That’s why it’s important to review your insurance policy to determine what coverage it provides for that equipment and those supplies. A standard homeowner, condo, or renter policy provides coverage for direct physical loss to property described in coverage C (personal contents) caused by specific listed perils. This means that if a particular type of loss isn’t listed, there would be no coverage.

If a cause of the loss isn’t on the list of covered perils AND it’s not specifically excluded, it may be a good idea to talk to your insurance agent to see if you can purchase additional coverage.

There are also certain types of personal property that can be scheduled for an additional premium. Examples include jewelry, cameras, coins, guns, and sports equipment. When property is specifically scheduled, the homeowners deductible would not apply.

What happens if your hobby becomes more than just a hobby? For example, you sell the crafts you make at craft fairs. How do you determine if your favorite hobby has become a business?

West Bend’s standard homeowners policy states:

Business means: A trade, profession or occupation engaged in a full-time, part-time or occasional basis; or any other activity engaged in for money or other compensation, except the following:

One or more activities… for which no “insured” receives more than $2,000 in total compensation for the 12 months before the beginning of the coverage period.

When your annual income exceeds $2,000, your standard homeowners policy would no longer provide coverage since your hobby would be considered a business activity.

In that case, you should talk to your agent again to determine if your policy provides adequate coverage for your hobby or business exposure.

by Flagship Staff | Jul 22, 2020 | Blog

For some, remote working sounds like the perfect work arrangement. You get flexible work hours, escape the office hullabaloo, and have more freedom with the way you work. However, a 2017 UN report points out that while telecommuting has its benefits, it tends to put a lot of stress on employees. In fact, 41% of people who work from home tend to be more physically and emotionally strained. That’s 16% higher than what’s been recorded for people who work in an office.

This is due to the fact that working from home presents a series of unique challenges. With telecommuting, it’s hard to keep a clear distinction between your work and personal life. One thing that may be sacrificed in this arrangement is a healthy relationship between you and your family. With all that said, we’ve come up with a few tips to help you create time for your loved ones while working remotely.

Create and follow a schedule

One of the key things to consider when working from home is creating a schedule that’s perfectly balanced. At home, it’s harder to keep track of time, especially if you’re engrossed in your work. This may lead you to unknowingly putting more time into your work and reducing the time you spend with your family. Open Source’s guide to creating a work schedule advises that you have to be strict with your start and end times. This means that you have to try to work only when you need to work, and use your breaks for personal development or to have a quick chat with your family.

Avoid getting distracted

You have to keep distractions at a minimum in order to have more time for your family and yourself at the end of your workday. One way to do this is by finding a quiet and secluded place in your house where you can work in peace. Also, discuss with your family that they have to respect your work hours and tell them to bother you only when it’s necessary.

Don’t forget to take care of yourself

It’s easy to forget to take care of your well-being when you have your work and family to think of; however, not taking care of yourself can pull down your work productivity, as well as your energy for your family. For starters, it helps to ensure that your home workstation is good for you and your body. Pain Free Working highlights the importance of ergonomics to avoid pain and stress from long hours of work. Be sure to find a comfortable chair with a backrest and maintain a good sitting posture all throughout your workday. Moreover, try to maximize your work breaks to give your brain time to recuperate. You can do this by doing something relaxing like meditation or listening to a podcast. This way, you’re in much better shape when it’s finally time to hang out with your family.

Try to think of fun activities

During your free time, you have to have some kind of bonding activity to help strengthen the relationship you have with your family. Some good examples are going on a bike ride together, having a cookout, and camping in your backyard. Whichever activity you choose, it’s important to find common ground with your family. This way, everyone enjoys the time they spend with each other.

by Flagship Staff | Jul 20, 2020 | Blog

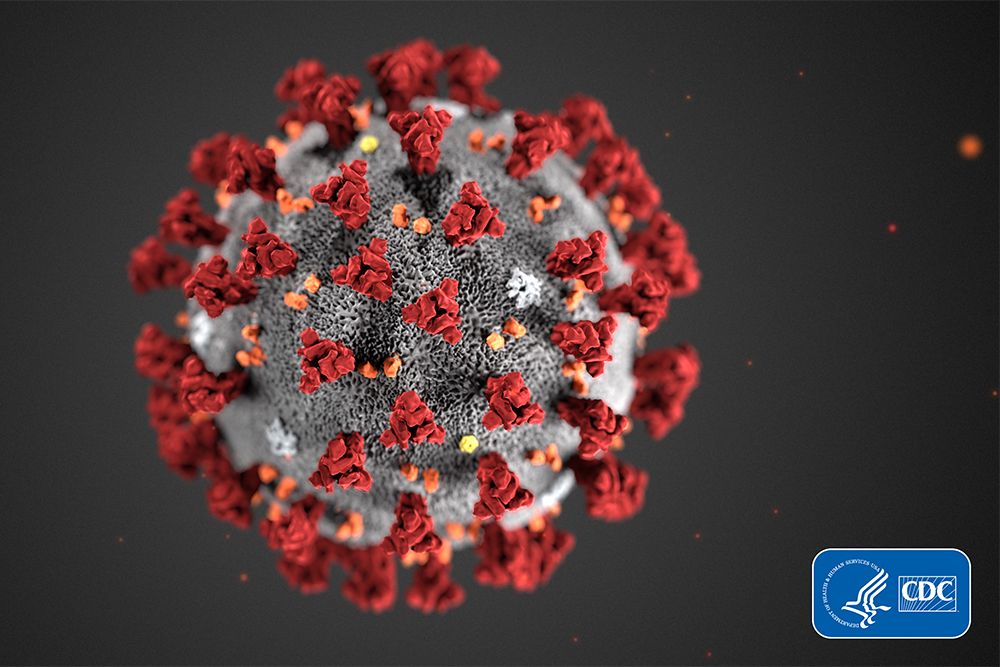

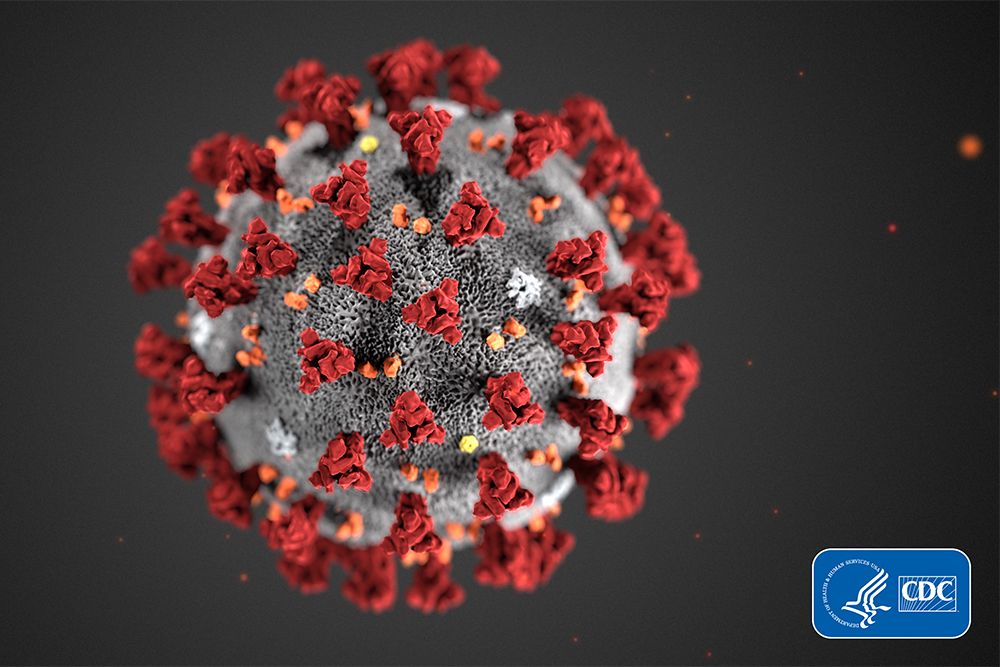

Below are links to updates on legislation, regulation and guidance on both the federal and state levels in response to COVID-19.

Congress

- During an interview on CNN, House Speaker Nancy Pelosi indicated “we absolutely have to” delay or cancel the August recess for the chamber in order to complete negotiations and reach an agreement with the Senate on the next coronavirus relief package.

- Senate Majority Leader Mitch McConnell (R-KY) continues to outline aspects of his COVID-19 relief package, which is expected to be released this week.

- Senators Chuck Schumer (D-NY) and Patty Murray (D-WA) released a white paper outlining a number of proposals to ensure COVID-19 vaccines are safe, effective, high quality, produced at scale, allocated in a manner that optimizes public health and reduces health disparities, free and accessible to everyone, and widely embraced by the public in order to end the pandemic and set the country on a path for economic recovery.

- Senator Kamala Harris (D-CA) announced the COVID-19 Bias and Anti-Racism Training Act, legislation to ensure health providers and other individuals involved in COVID-19 testing, treatment, vaccine distribution, and response receive bias and anti-racism training.

- Senate Democrats unveiled a proposal, the Economic Justice Act, which would offer $350 billion in child care, job training, health care, and minority community investments.

- Representative Mike Kelly (R-PA) introduced H.R. 7538, the Essential Workforce Parity Act, which would extend paid leave required by the Families First Coronavirus Relief Act (FFCRA) to health care workers and offer liability protections to hospitals and other medical providers from certain lawsuits during the COVID-19 emergency declaration.

- Representatives Joseph Morelle (D-NY) and Mark Takano (D-CA) introduced legislation to create a massive new jobs training program to combat COVID-19 and help communities across the country safely re-open.

- Representative Tom Rice (R-SC) will introduce legislation to provide a tax credit for businesses to safely reopen and pay for extra safety measures amid the coronavirus pandemic.

- Ways and Means Republicans introduced two new bills as part of their policy agenda to help Americans returning safely to a healthy workplace.

- Representatives Mike Thompson (D-CA), Peter Welch (D-VT), Bill Johnson (R-OH), David Schweikert (R-AZ), and Doris Matsui (D-CA) introduced the Protecting Access to Post-COVID-19 Telehealth Act, which would continue the expanded use of telehealth beyond the coronavirus pandemic by eliminating restrictions on the use in Medicare, providing a bridge for patients currently using the practices because of the crisis, and requiring a study on the use of telehealth during COVID-19.

- Representative Cedric Richmond (D-LA) introduced the COVID Testing Transparency Act, which would require the Trump Administration to share COVID-19 testing data with Congress and the public.

Administration

- White House spokesman Judd Deere issued a statement that President Trump will not sign into law a phase four coronavirus relief package that does not include a payroll tax cut.

- The Department of Labor announced a Request for Information regarding the impact of paid family and medical leave on America’s workforce.

- The Department of Labor’s Wage and Hour Division (WHD) announced significant steps to streamline optional-use forms that workers can use to request and employers can use to coordinate leave under the Family and Medical Leave Act (FMLA).

- The Small Business Administration (SBA) issued a procedural notice, which informs Paycheck Protection Program (PPP) lenders of the reporting process and collection of processing fees.

- The Federal Reserve announced an extension of a rule change to bolster the effectiveness of the SBA’s PPP.

- HHS, through the Health Resources and Services Administration (HRSA), announced it will begin distributing $10 billion in a second round of high impact COVID-19 area funding to hospitals starting next week.

States

- The White House provided a readout from Vice President Pence’s governors briefing on COVID-19 response and best practices.

- Track where all 50 states stand on reopening here.

- The Centers for Disease Control and Prevention released resources to assist states to reopen.

- CMS has approved over 200 requests for state relief in response to the COVID-19 pandemic, including recent approvals for Alaska, Iowa, Hawaii, New Jersey, North Carolina, Pennsylvania, Rhode Island, Utah, and Virginia.

by Flagship Staff | Jul 15, 2020 | Blog

If you own a boat, now’s the time to start having fun in the sun. If you’re thinking about buying one, there are many benefits to ownership. Benefits include:

Creating family memories

Staying active

Reducing stress

Supporting your passion

Enjoying nature

Unfortunately, a great day on the water can turn tragic when simple safety tips are forgotten. Each year the U.S. Coast Guard responds to incidents that result in injury and death. The leading contributors to watercraft crashes include operator inexperience, inattention, recklessness, and speeding. Whether you’re fishing, riding in a boat, jet skiing, or paddling a kayak, here are some safety tips that can keep you and your family safe.

1. Take a boating safety course. If you’re new to boating or have kids who want to drive the boat, consider enrolling your family in a boating safety course. Courses cover a variety of topics such as:

Boat safety

Boat handling

Identifying weather patterns

Navigation skills

To find an online class, click here or visit your state’s Department of Natural Resources (DNR) website.

2. Pay attention to the weather. There are plenty of weather apps available to help you keep track of weather conditions while you’re boating. If you know phone service is an issue, make sure you check the local forecast before going out on the water. Heavy rain, lightning, and high winds can be catastrophic if you’re out on the water when a storm front rolls in.

3. Life jackets save lives. Before you head out on your water adventure, double check to make sure you have a life jacket for each person on board. Make sure children always wear them. If you choose not to wear one, make sure you keep an eye on the weather conditions and put one on if they become dangerous. Big waves or high winds could toss you overboard causing panic and possibly a fight for your life. A life jacket can keep you afloat and keep your face out of the water if you’re unconscious. Like a seatbelt, wearing a life jacket can increase your chance of survival!

4. Keep your boat afloat. It’s important to understand your boat’s capacity requirement. Carrying too many passengers or equipment could throw your boat out of balance. A balanced boat performs more efficiently and keeps those onboard safe.

5. You’re the captain of the ship. Your number one priority should be the safety of your passengers and crew. Explain your rules so everyone on board knows what’s expected. Show them where extra life jackets are kept, as well as fire extinguishers. Setting expectations up front can create a safer and more enjoyable voyage.

6. Review state laws and navigational rules. Understanding the laws and rules is important to keep you and other boaters safe. Jumping into a boat and going for a ride without this knowledge can be dangerous. To familiarize yourself with navigational rules and your state’s boating laws, click the links below.

Safety Videos

https://www.uscgboating.org/regulations/state-boating-laws.php

7. File a float plan. Whether traveling to another country or taking a road trip, it’s always a good idea to share your itinerary with friends, family, or a neighbor. This is also true if you’re going boating, especially on a large body of water. If an emergency arises, it may be difficult for someone else to remember what you told them. A float plan identifies:

Type of vessel

Communication systems

Survival gear

Persons onboard

For a copy of a float plan, click here.

8. Communication is key. If you go boating on decent size inland lake, you’ll probably see boats pulling skiers, tubers, and wakeboarders. Depending on the size of the lake and the number of boats, congestion can become a problem. Having a spotter on your boat and understanding basic hand signals is critical. To familiarize yourself with the basic hand signals, click here.

9. Stow a boat safety kit. A boating emergency can arise at any time. No matter the size of your boat, make sure you have the necessary survival items. These items include:

Prescription medication

Water

Packaged food

Sunblock

Flashlight

Whistle

Fire extinguisher

Navigation lights

VHF radio

Cell phone

Visual distress signals

A bucket or bailer

Extra fuel

Oars or paddles

Please note this isn’t an all-inclusive list. Depending on the size of the body of water, you may need additional supplies.

10. Be respectful. Respect the boat, passengers, and other boaters. Trying to push the boat beyond its limits can be dangerous. Trying to send a skier or tuber over a big wave may seem like fun, but it can cause serious bodily injury, especially if the person isn’t skilled or expecting it.

by Flagship Staff | Jul 8, 2020 | Blog

Owning a house makes you realize the significance of ventilation. Improper ventilation in the bathroom can lead to an incessant war with mold and mildew. If your kitchen has insufficient ventilation, the smell of food may remain for days. And if you don’t provide proper vents on the roof, you’ll face several problems, both outside and inside the house. Fortunately, an experienced contractor can fix ventilation issues easily.

If you notice that your house is hotter in the summer and much colder in the winter than expected, or if you go to the attic, only to face an unexpected gush of hot air, then maybe your roof doesn’t have proper ventilation.

Roof ventilation is one of the most critical aspects of keeping your house and loved ones healthy. Unfortunately, problems related to ventilation can prove to be subtle and can develop without your knowledge, surprising you with hefty repair costs.

Why roof ventilation?

Roof ventilation doesn’t only affect your roof, but also your home’s cooling and heating system and the electricity bill. It provides continuous airflow through the attic and helps to remove moisture and overheated air, reducing the aftermath of altering temperatures and moisture formation inside the house.

Proper ventilation releases any heat gathered in the attic during the winter season. Excessive heat present inside your house can melt the snow accumulated on the roof faster and can lead to the formation of ice dams, which isn’t good for your house.

During the summer season, bad roof ventilation often leads to the trapping of heat inside the attic, affecting cooling systems and reducing the energy efficiency of your house.

A good roof ventilation system releases unnecessary heat present in the attic and protects your roof and air conditioning systems.

Sometimes moisture buildup can cause the formation of mold and mildew, causing significant damage to the interior of the attic and substructure of the roof. Nails can rust and even break, and the roof deck can rot. The roof ventilation system allows the moisture and heat to escape, hence reducing the possibilities of such disastrous issues.

Problems caused by poor roof ventilation

Ordinary chores like doing the laundry, cooking, or taking a shower could lead to the formation of moisture and heat inside the house unless a proper ventilation system is present. The accumulated heat and moisture could lead to the following issues:

1. Mildew and mold. A humid environment and the resulting condensation can lead to the formation of mold and mildew. It leads to the decomposition of items in the attic and can also cause severe health issues.

2. Ice dams. They prevent the accumulated snow from falling off the roof and stop the water from the melted snow from flowing down. This water gets accumulated under the shingles which leads to its infiltration inside your house, causing significant damage to the drywall and paint. Also, the ice hanging on the gutters is heavy and may damage the gutters and lead to poor drainage too.

3. Rusting. The moisture and humidity will also collect on metal pipes and nails, leading to the formation of rust. This, in turn, can lead to the failure of venting and plumbing straps.

4. Sagging of the deck. The presence of moisture in the air will ultimately lead to its absorption into roof decks, dissolving the adhesives, spoiling its shape, and making it feel soggy to walk on. This presents a grave threat to anyone who walks on it.

5. Hot and cold spots. Inadequate ventilation can lead to distinguishable changes between different rooms in the same house. Some rooms might feel warm, while others might feel cooler. This can lead to increased electricity expenses.

6. Roof system disintegration. Excess moisture and heat can spoil the shingles and undergirded material which gives support to the attic. The untimely loss of grains or cracking roofing slates indicate inadequate ventilation.

Maintaining roof ventilation systems

You should examine your roof along with the ventilation system every few years. Look for weather abrasion like cracks, absent tiles, and loose or ruptured vents. Also, look for anything that can block the vent like leaves and debris. Check inside the attic for any kind of damage caused by moisture or heat.

The attic insulation is one of the most crucial aspects of your house. Keep that in check for any variations in temperatures around the house. You also need to insulate your house properly to be safe from the temperature outside, so check the proper placement and order of the vents across the roof.

You can obtain the help of roofing companies to resolve any problem related to vents and roofs. Performing a proper check on the roofs can lead to a long-lasting, well insulated, and healthy home for you and your family.